By: D. Larry Crumbley, Contributor to the South-Western Federal Taxation series

Stock-based compensation (e.g., stock options and option awards) is generally the largest single component of compensation paid for most of the largest public companies, and companies also offer these types of benefits to rank-and-file employees. Jack Ciesielki in 2017 found that salaries and bonuses were around 14.5%, pension and deferred pay 4.5% and equity-type compensation around 59% for large-company executives.

For example, in 2018 the highest paid CEO was Elon Musk of Tesla, Inc., whose entire $513 million salary was option awards, and the fourth highest paid CEO, Tim Cook of Apple, Inc., had $126 million of his $141 million compensation in stock awards. The fifth highest paid CEO, Nikesh Arora (Palo Alto Networks), had $72 million in option awards and $39 million in stock awards out of a $130 million package. Of course, stock awards are often contingent on performance conditions, and payouts are often reduced if performance is not met.

Stock-based compensation helps motivate executives and employees to higher levels of performance, retain employees and recruit new talent. Importantly, stock option and option awards minimize an employer’s after-tax cost and maximizes an employee’s after-tax benefits. An executive benefits when the company’s stock goes up and does not lose if the share price goes down.

Types of Stock Options

There are two major types of stock options: incentive stock options and non-qualified stock options. Rather than paying compensation in the form of cash or corporate stock, a corporation issues options to purchase stock at a specific price to an employee. Stock option plans are used more frequently by publicly traded companies than by closely held companies. This difference is due to the problems of determining the value of the stock of a company that is not publicly held, which is a practical requirement now to avoid the 20% excise tax under § 409A.

Nonqualified stock options (NQSOs) are more flexible and less restrictive than qualified incentive stock options (ISOs). For example, the holding period for an NQSO is not as long as that of an ISO. However, the option price of an NQSO cannot be less than the fair market value of the stock at the time the option is granted. An NQSO creates an employer deduction that lowers the cost of the NQSO to the employer. The employer may pass along this tax savings to the employee in the form of a cash payment. Both the employer and the employee may be better off by combining NQSOs with additional cash payments rather than using ISOs. Most stock options are nonqualified stock options.

Comparing Stock Options

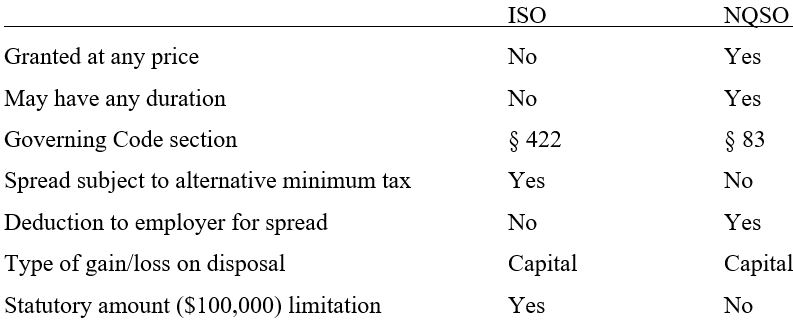

Below is a comparison of incentive stock options and non-qualified stock options:

Ideas for Class Assignments

- Have students determine the 20 highest paid CEOs in 2019 and calculate their percentage of stock-based compensation. Determine the overall percentage of stock-based compensation.

- Have students review IRC § 409A.

- Define and examine phantom stock and stock warrants.

References:

- Jack Ciesielski, “2016 S&P 500 Executive Pay: Why and How Much It Matters to Shareholders,” The Analyst’s Accounting Observer, Vol. 26, No. 9 (August 25, 2017).

- Melin, A. et al., “A 300% Surge Makes Pot CEO No. 2 in Pay Ranking after Elon Musk,” Bloomberg, May 17, 2019.

- IRC §§ 422(b), 83 and 409A.

- §§ 1.421-6(c), (d) and (e).

SWFT Chapters:

Interested in earning FREE CPE credit? Reach out to your Cengage Account Executive to be added to the mailing list for upcoming events!