By: Annette Nellen, Co-Editor of the South-Western Federal Taxation series

Every session of Congress, hundreds of bills are introduced with tax changes and very few get enacted into law. As a result, few get the benefit of discussion among members of the tax-writing committee and the public. Yet, many of the proposals are excellent vehicles to help students reinforce understanding of tax rules and principles of good tax policy.

An example of a bill where analysis is needed to understand the sponsor’s claim for why it is needed, is H.R. 4947, Small Business Prosperity Act, which among other changes, would increase the §199A deduction from 20% to 43% (47% after 2025). The sponsor suggests the following for why this change is needed: “Lowers the maximum tax rate on small business revenue to 21 percent—the same low rate that major multinational corporations have been benefiting from since 2018.”

Is that correct? What about the tax effect of double taxation of corporate earnings? What about the fact that many business owners have a marginal tax rate of 24% or lower?

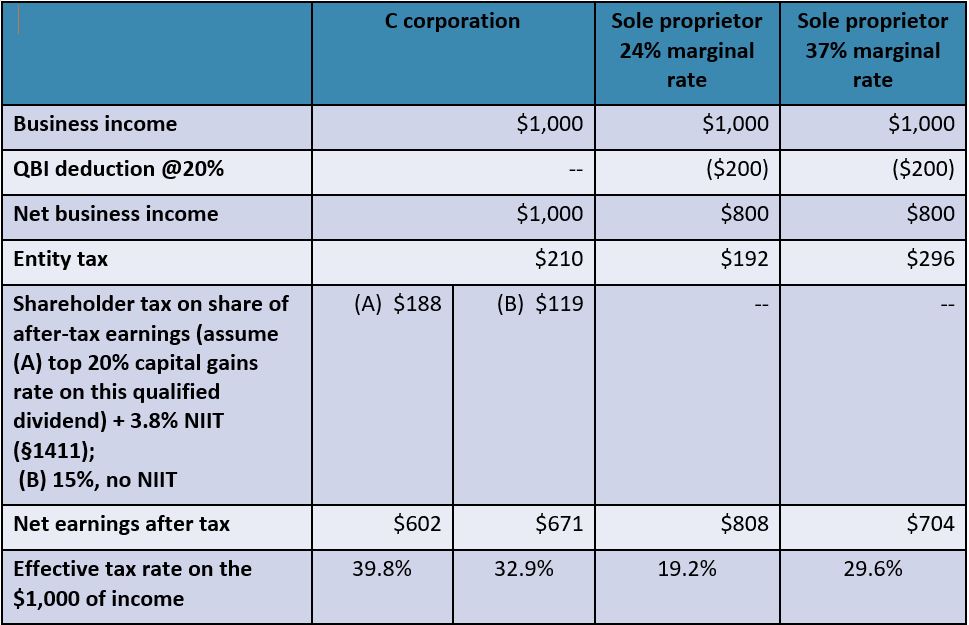

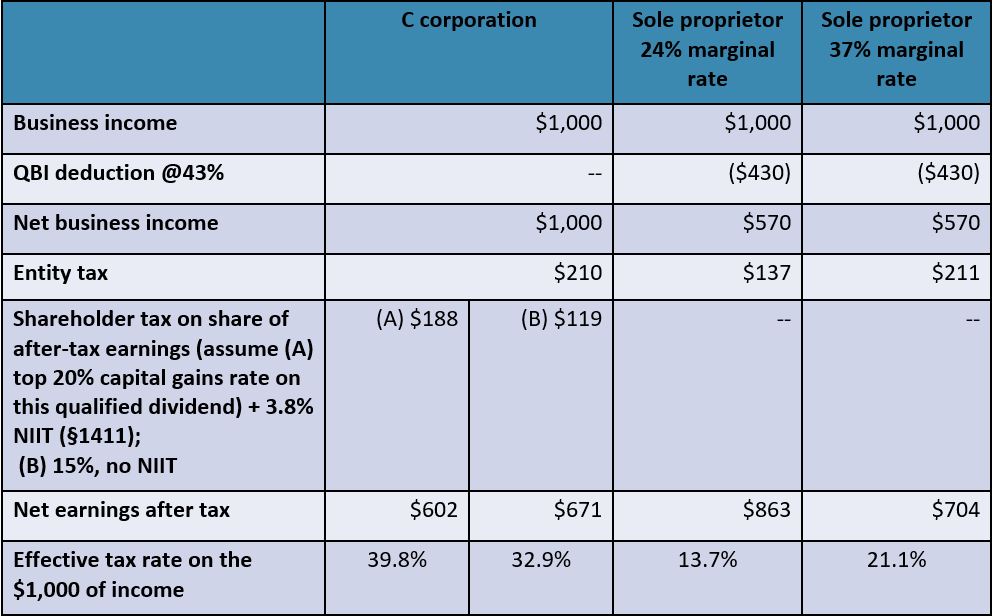

One approach for analyzing the sponsor claim is to prepare comparisons of the effective tax rate on a common amount of business income for a C corporation and sole proprietors at varying marginal personal income tax rates.

An example of these calculations follows.

Effective tax rates under current law:

Here is the analysis with a 43% QBI deduction percent per H.R. 4947:

This analysis shows that the effective business tax rate of 21% will occur for business owners at a 37% marginal tax rate, which is less than 5% of individuals. Sole proprietors below a marginal rate of 37% already have an effective tax rate on their business income that is below 21%. This rate is lower than the effective tax rate for C corporations when double taxation is assumed. Of course, a corporation may be able to delay making distributions.

CLASS ASSIGNMENTS

Questions for students to consider:

- What other factors should be considered in evaluating H.R. 4947?

- Should H.R. 4947 be enacted to lower the rate on non-C corporation income to 21% to match the rate on C corporations?

- If the corporate rate is increased to help reduce the debt and deficit that increased with COVID-19 tax changes, should the 20% QBI deduction also change? Explain.

- Should self-employment tax be factored in for the sole proprietors or does that serve a different purpose than income tax on business income? Explain.

- Is there an alternative to the QBI deduction to equalize the income tax rate structure on business income regardless of the type of entity? Is this appropriate? Why or why not?

SWFT Chapters:

SWFT Individuals: Chapters 1 & 9

SWFT Essentials: Chapters 1 & 11

Interested in earning FREE CPE credit? Reach out to your Cengage Account Executive to be added to the mailing list for upcoming events!

To view previously recorded webinars, visit our events page.