SWFT Tax Blog, March 2020

Author: Toby Stock

Chapters

- Individuals, Chapter 11

- Comprehensive, Chapter 11

- Essentials, Chapter 12

Introduction

Students (and others) often do not understand how a “business” that breaks even on before tax cash flows can be a desirable investment. However, this was a possible outcome before Congress enacted §469. The example below demonstrates how, despite annual zero before-tax cash flows, a tax shelter can generate a positive after-tax net present value.

Idea for Class Discussion or Assignment (See notes below for some thoughts on this.)

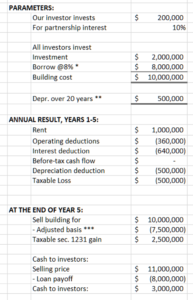

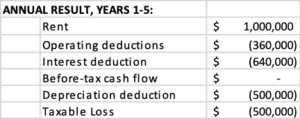

Problem: Suppose the year is 1979. A high-income taxpayer has a marginal tax rate of 50%, with an effective rate for long-term capital gains of 20%. This taxpayer can invest in a rental office building for $200,000 and receive a 10% limited partnership interest. The partnership has $2,000,000 of equity and borrows $8,000,000 at 8% for five years to purchase or construct a $10,000,000 office building, which it rents for $1,000,000 annually. The general partner’s management fee and other operating expenses total $360,000. The loan will require interest-only payments annually with principal repayment at the end of 5 years. The partnership will depreciate the building straight-line over 20 years. The partnership expects to sell the building for cash of $11,000,000 at the end of five years.

Required: What are the partnerships before- and after-tax cash flow each year? What are the taxpayer/investor’s before-tax cash flows for the taxpayer for each year? What are the after-tax cash flows? What is the net present value of the after-tax cash flows? Assume that all cash flows occur at the end of the year and that the taxpayer/investor has a 10% discount rate.

Assignment Notes

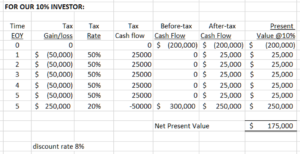

Students will have to compute several amounts for the partnership before computing cash flows for the taxpayer/investor. First, the annual cash flow and taxable loss for the partnership is:

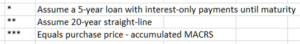

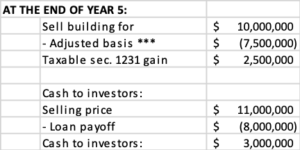

Note that the annual before- and after-tax cash flow is zero—the investment is not profitable absent tax consequences. Finally, the “at-end” cash after the sale of the building is:

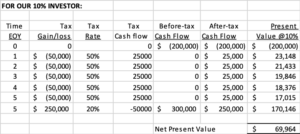

With this information, students can compute the cash flow analysis for the 10% taxpayer/investor. The first column is the year. The second is the investor’s share of the partnership’s annual loss or its gain on sale of the building in year five. The third column is the appropriate tax rate for the income or loss, and the fourth column is the tax savings (years 1-5) and tax cost (year 5). The fifth column is the before-tax cash flow (the investment and the share of sales proceeds), and column six is the after-tax cash flow, combining the tax cash flow and the before-tax cash flow. The last column is the present value of each after-tax cash flow using a discount rate of 10%.

It is clear that, absent taxes, the investment is profitable: the investor invests $200,000 and receives $300,000 in five years. However, this generates a negative net present value. In contrast, after considering the tax cash flow in the table above, the investment generates a positive net present value.

It is easy to show students that this will not work in the current tax regime because the passive loss rules will eliminate the tax benefits of the annual losses until the end of year five.

Support